unemployment tax refund 2021 status

The IRS issues more than 9 out of 10 refunds in less than 21 days. Estimate Your 2022 Tax Refund For 2021 Returns.

46 Of Taxpayers Plan To Save Their Refunds This Year

Calling the IRS TeleTax System at 800-829-4477 or the IRS Refund Hotline at 800-829-1954.

. Congress hasnt passed a law offering a. Tax refund time frames will vary. We are processing these returns in the order received and.

You can prepare the tax return yourself see if you qualify for free tax preparation or hire a tax professional to prepare your return. Encourage your employees to file an updated Form W-4 for 2022 especially if they owed taxes or received a large refund when filing their 2021 tax return. Unemployment insurance is taxable income and must be reported on your IRS federal income tax return.

The 120th day after the end of the tax year if the return for the year is filed on time. It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020.

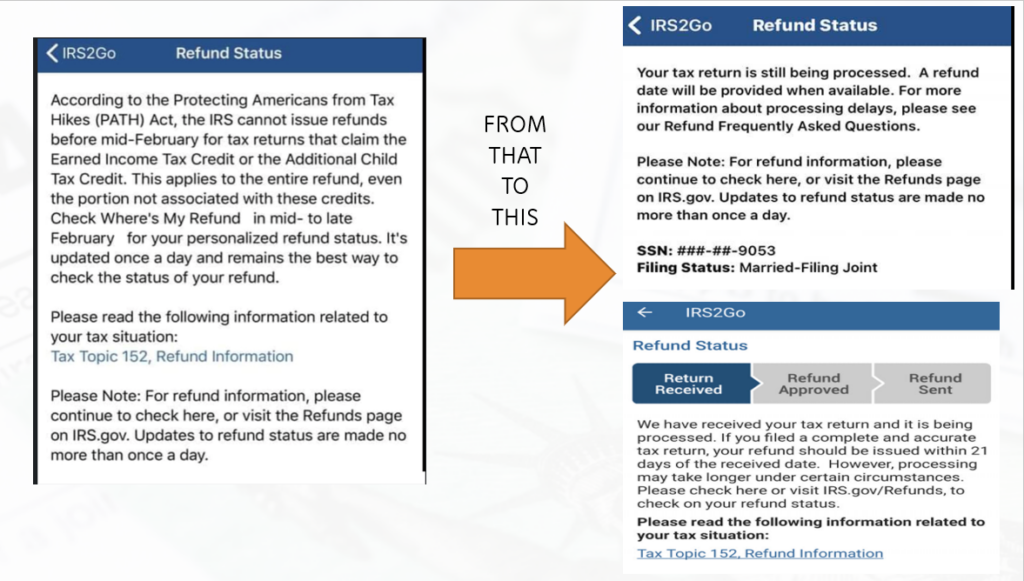

They still say that checking the WMR website or IRS2Go app is the best and official way to check your refund status. And before January 1 2021. Will I receive a 10200 refund.

You were going to receive a 1500 federal tax refund. The completed line items are. What if I cant pay now.

Refund requests for tax withheld and reported on Form 1042-S Form 8288-A or Form 8805 may require additional time for processing. This is an example of Form 1040 2021 as pertains to the estate described in the text. What are the unemployment tax refunds.

Ways to check on the status of your refund. The IRS updates the information once a day usually overnight. Making a tax payment.

Heres an example. However see Dual-Status Aliens later. You can also check the status of your tax refund by.

March 12 2021. TOP will deduct 1000 from your tax refund and send it to the correct government agency. Making a tax payment.

The IRS is however setting expectations that your refund may be delayed for a variety of reasonsThe most common. If you used e-Collect and one the IRS and State agency have released your Refund money check the e-Collect Refund Status. Across the top of the form states.

Your decision to file single jointly or as head of. Your local state unemployment agency will send you form 1099-G to file with your tax return see due dates. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax. The IRS is reviewing implementation plans for the newly enacted American Rescue Plan Act of 2021.

As of August 27 2022 we had 19 million unprocessed Forms 1040-X. The difference in tax rates are significant and can mean the difference between paying up to 10 percent or 35 percent. Resident for tax purposes if you are a lawful permanent resident of the United States at any time during calendar year 2021.

W-2G 1099-R 1099-MISC 1099-NEC etc. One-half of the employer share of social security tax was due by December 31 2021 and the remainder is due by December 31 2022. Then select your IRS Tax Return Filing Status.

The date of the overpayment. Refunds of certain withholding tax delayed. I have the earned income credit from 2019 plus 2021 unemployment.

Choose Wheres My Refund. Other ways to check your federal refund status. Yes the Canada Revenue Agency will pay you compound daily interest on your tax refund.

USPS tracking confirms it was received July 20 2021. For 2021 if you received an Economic Impact Payment EIP refer to your Notice 1444-C Your 2021 Economic Impact Payment. Are you entitled to receive interest on your refund.

Fastest refund possible. I mailed my 2021 federal tax return in July 2021. As of February 18 the average refund was 3586.

Learn More About State Tax Returns State Extensions and State Amendments. Individual Income Tax Return 2021 Page 1. Get your tax refund up to 5 days early.

But you are delinquent on a student loan and have 1000 outstanding. Plus I cant. What if I cant pay now.

And interest and dividend statements from banks and investments firms Forms 1099. Were working hard to get through the carryover inventory. This form is sent in.

Individual Income Tax Return 2021 Page 1. Check the IRS Tax Return status of your 2021 Return. Attachment to Form 1041--do not detach.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. You can check the e-file status of your federal tax return with our online Wheres My Refund tool. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. If you make 40000 a year for instance the amount of tax you will pay depends on which filing status you qualify for.

To know how much federal income tax to withhold from employees wages you should have a Form W-4 on file for each employee. Your filing status can make a big difference in how much income tax you pay. The CRA will start paying refund interest on the latest of the following 3 dates.

Because both December 31 2021 and December 31 2022 are nonbusiness days payments made. Each employers tax rate may vary from year to year depending on previous experience with unemployment and the rate schedule in effect. Fastest tax refund with e-file and direct deposit.

Once an employer becomes eligible for experience rating they will receive one of 18 unemployment insurance UI tax rates ranging from 25 percent to 540 percent of taxable wages. Unemployment compensation statements by mail or in a digital format or other government payment statements Form 1099-G. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax.

This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. Yes No Self. Tax Topic 151 vs 152 notice.

COVID Tax Tip 2021-87 June 17 2021. Please dont file a second tax return or contact the IRS about the status of your return. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022.

Status of Processing Form 1040-X Amended Individual Tax Return. See Important IRS Federal Tax Day Deadlines and Due Dates and State Income Tax Day Deadlines and Due Dates. Additional information about a new round of Economic Impact Payments the expanded Child Tax Credit including advance payments of the Child Tax Credit and other tax provisions will be made available as soon as possible on IRSgov.

Youll need your Social Security number your filing status single married filing jointly married filing separately head of household qualifying widower and the exact amount of the refund youre expecting from your tax return. Ways to check on the status of your refund. TC 152 could have several implications once the IRS finishes initial processing but when you see this message it basically just means the tax return has been received and is being processed and the next status or actions has to be finalized.

Updated March 23 2022 A1. Tax Calculator Refund Estimator for 2022 IRS Tax Returns.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Where S My Refund Home Facebook

Irs Sends Out 1 5 Million Surprise Tax Refunds

Tax Refund Timeline Here S When To Expect Yours

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

When Will I Get My Irs Tax Refund Latest Payment Updates And 2022 Tax Season Statistics Aving To Invest

You Have One Last Chance To Get A Surprise Tax Refund This Year The Irs Says

Do I Need To File A Tax Return Forbes Advisor

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Tax Refund Timeline Here S When To Expect Yours

Average Tax Refund Up 11 In 2021

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Tax Refunds 2022 Why Did You Only Get Half Of Your Tax Return Marca